Can China Catch up in Semiconductors?

China needs to clone TSMC

China has an uphill battle to catch up with the U.S. in Semiconductors, Cloud computing and A.I research. However, it’s Semis that is probably the hardest one.

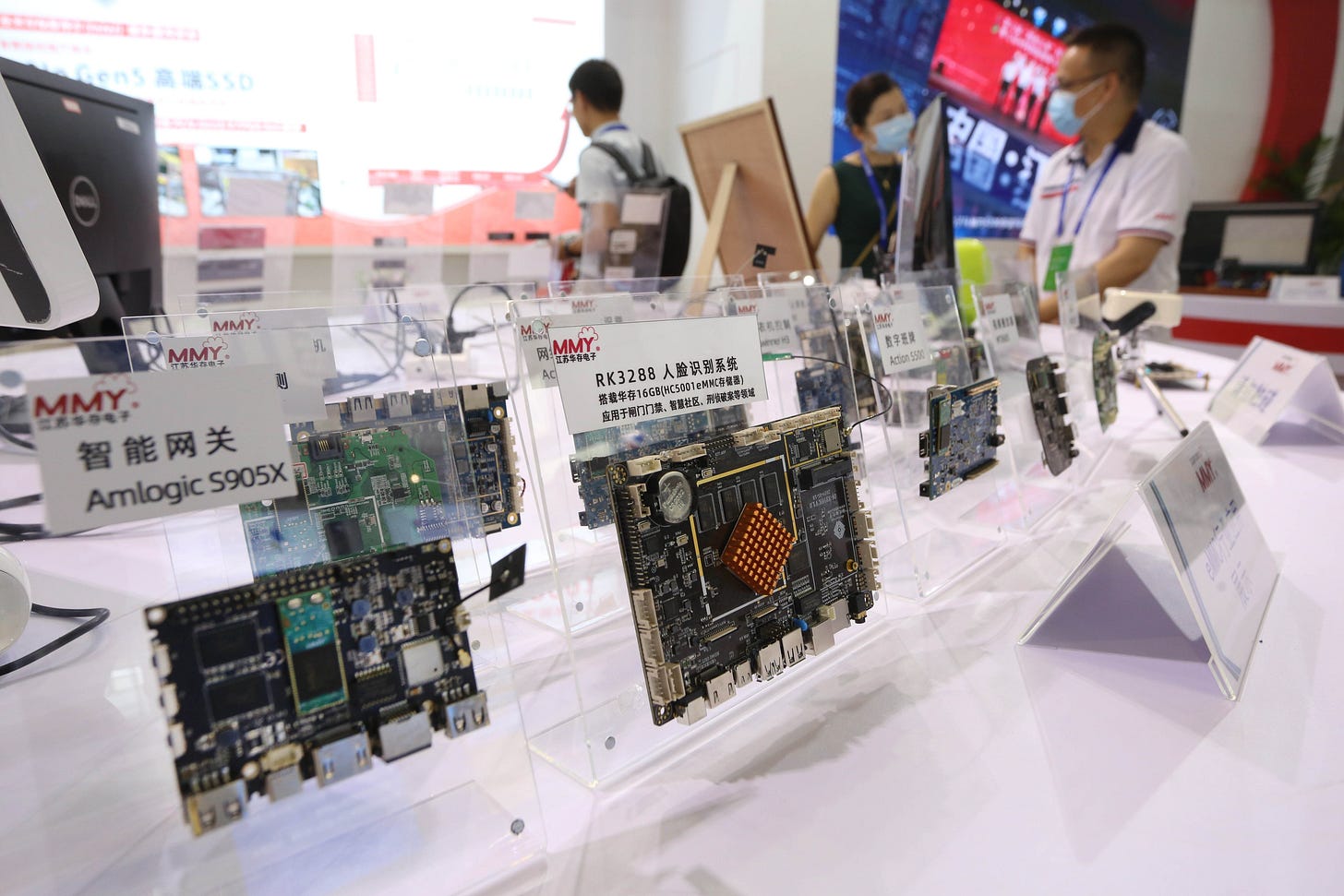

Semiconductors are used in everything, from smartphones and computers to cars as well as home appliances. In 2022, China is trying its best to close the supply-chain gaps, attract the talent and fast-track production but it’s way behind and dangerously reliant on external suppliers.

Chinese technology giants from Alibaba to Baidu have been designing their own chips, a move seen as progress towards China’s goal to boost its domestic capabilities in a critical technology.

China’s reliance on foreign companies in the semiconductor supply chain could make domestic firms vulnerable to any geopolitical tensions as has been the case with both Huawei and SMIC.

The West can harm China’s rise by targeting just a few of their companies strategically. That’s what happend to Huawei and likely to happen to ByteDance, among others.

Why Are Semiconductors So Important for China Now?

The world’s second-largest economy has for years invested heavily into boosting its domestic chip industry, but it has struggled to catch up with rivals in the U.S. and other parts of Asia. Increasingly, semiconductors are seen as key to national security for many countries and a sign of technological prowess.

China’s semiconductor industry faces considerable challenges

China is failing a lot recently in doing this. While these companies are designing their own chips, they might still have to rely on foreign tools to do so. But when it comes to manufacturing and the broader supply chain, China’s internet giants are still heavily dependent on foreign companies.

For several years now, China has talked about doing more — like spending more money on research and development — to achieve self-reliance in science and frontier technologies, including semiconductors and artificial intelligence. While it’s winning in A.I., it’s losing in Semiconductors. If only it had Taiwan’s luxurious leadership in this industry.

High level semiconductor engineers are also more expensive to produce. A closer look at the specifics of the silicon being designed shows China’s reliance on foreign companies.

China Needs to Develop a Chip Manufacturing “Golden Sheep”

Take Alibaba’s new Yitian 710 chip. That is based on architecture from British semiconductor firm Arm. It will also be built upon the so-called 5-nanometer process, the most advanced chip technology at the moment.

China simply in 2022 does not have a company capable of manufacturing these leading edge semiconductors at these sizes. They will have to rely on just three companies — Intel from the U.S., TSMC from Taiwan and Samsung in South Korea. China doesn’t have a golden sheep of chips.

Beijing stepped up its efforts as the United States targeted Chinese tech companies like Huawei and SMIC with sanctions as tensions escalated between the two superpowers. Optimistic predictions would be that China can catch up by 2028 and surpass the U.S. in semiconductors by 2034. That’s still a relatively long ways off.

Even as China spends billions to build up its domestic semiconductor sector, it is still some time away from achieving the capabilities needed to produce cutting edge chips. Money isn’t everything you need the skill labor and the talent to do it, and the expertise. China’s track record on luring talent from abroad isn’t great.

But it is not the United States that is leading in the semiconductor market. In terms of manufacturing it is Korea and Taiwan that own 81% of the market and in terms of machinery, only the Netherlands produce the extreme ultraviolet (EUV), needed to make the most advanced chips.

China needs to aim to catch up in the Cloud and Semiconductors to equalize their slow advantage in some aspects of artificial intelligence emergence at scale. China leads the world in E-commerce and smart city architecture in the 4th industrial revolution.

China considers Taiwan part of China, but the rest of the world does not, nor does Taiwan itself. Chips are made using a process called lithography where highly complex and expensive machines shine very narrow beams of light onto silicon wafers that have been treated with “photoresist” chemicals to create intricate patterns.

The global semiconductor shortage is still a major story in 2022. But it’s not just manufacturing. Even companies like TSMC and Intel rely on equipment and tools for the manufacturing process from other companies. Supply chains and global trade is so important here. China’s actions do not do it any favors on the global stage.

The semiconductor ecosystem is large and complex, so building self-sufficiency is very difficult across such a broad range of technologies and capabilities. But if anyone can do it in the next ten or twenty years, it’s China.

The reliance on foreign companies leaves Chinese firms vulnerable to any geopolitical tensions — as was the case with both Huawei and SMIC. China needs to understand the importance of diplomacy, even as many of its citizens were riding bicycles in the 1990s, it’s come a long ways. But it should not be too arrogant. Global public opinion on China is pretty low, especially its Government.

However, the U.S. put Huawei on a trade blacklist called the Entity List in 2019 which cut off the Chinese company from certain U.S. technology. Last year, Washington introduced a rule which requires foreign manufacturers using American chipmaking equipment to get a license before they’re able to sell semiconductors to Huawei.

China’s need for self-sufficiency

For several years now, China has talked about doing more — like spending additional money on research and development — to achieve self-reliance in science and frontier technologies, including semiconductors and artificial intelligence.

China needs to clone Taiwan’s TSMC. Taiwan’s industrial policies and vision created an incredible leader in a very specialized and complex field.

Huawei’s chips were manufactured by TSMC. But when the U.S. rule was introduced, TSMC could no longer make semiconductors for Huawei.

AMD and Qualcomm are both using TSMC to print chips. TSMC is a Taiwanese company. Taiwan is a separate country, it is in no way part of China. China needs to develop its own companies around this problem to achieve greater self-sufficiency.

When it comes to National Security, China will not spare any investment required. Governments around the world now see semiconductors as extremely strategic and important technology.

U.S. President Joe Biden has called for a $50 billion investment in semiconductor manufacturing and research and has looked for chipmakers to invest in the country. In March, Intel announced plans to spend $20 billion to build two new chip factories, called fabs, in the U.S.

The U.S. blacklisting Huawei we basically the start of the Cold-Tech wars between China and the United States. Although corporate espionage for decades on the part of China was the real trigger.

Washington has looked to bring semiconductor manufacturing back to the U.S., seeing it as key for national security, given the supply chain is very concentrated in Asia. The bifurcation of the global supply chain is very dangerous for the future creating an East vs. West dynamic. China will end up as the leader of the Eastern Bloc. Japan, Taiwan and other parts of Asia like Singapore or Indonesia likely want to side with the U.S. for however long they can. So this problem is lined with geopolitical tension and strategic technologically battles for supremacy and antiquated nationalism.

If Beijing can’t solve the Semiconductor problem, it cannot overtake the U.S. as a technology super-giant.

Leaders of the the United States, India, Japan and Australia, a group known as the Quad, announced plans in September to establish a semiconductor supply chain initiative aimed at identifying vulnerabilities and securing access to semiconductors and their vital components. It’s unclear frankly if China can respond, or how long it will take China to catch up in this specific area of great importance to the future of technology.